|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

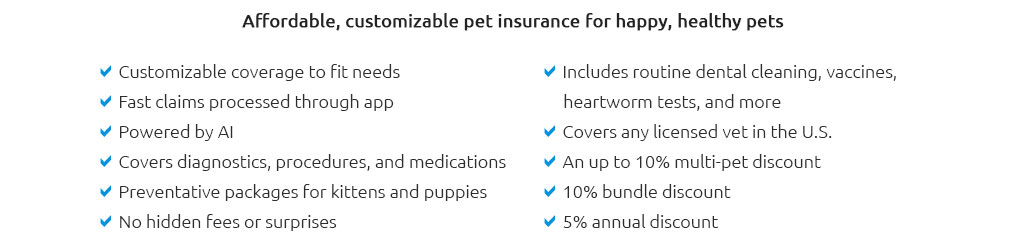

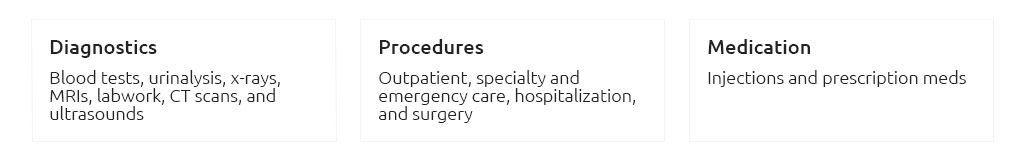

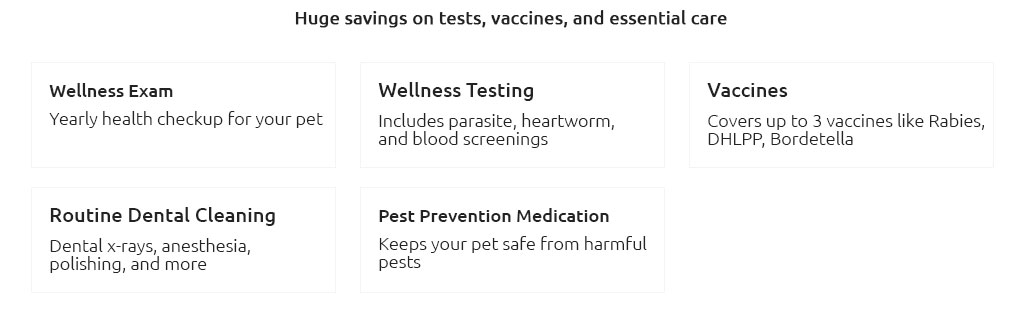

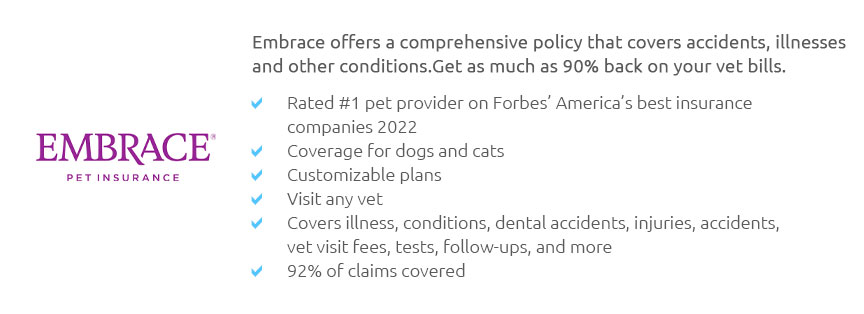

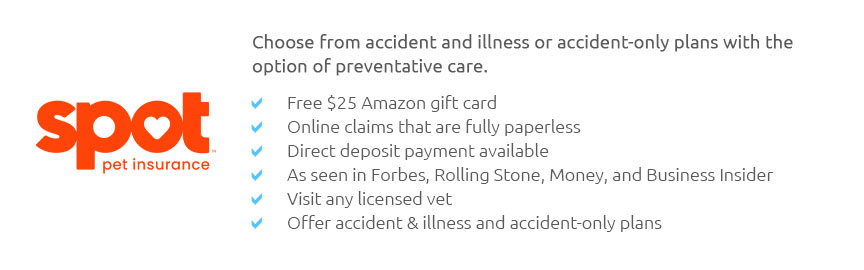

The Ultimate Guide to Choosing the Best Pet InsuranceWhen it comes to our beloved pets, ensuring their health and well-being is paramount, leading many to explore the myriad options available for pet insurance. Navigating this landscape can be daunting, given the multitude of companies and plans, each promising comprehensive coverage and peace of mind. This guide delves into the intricacies of selecting the most suitable pet insurance for your furry friend, offering insights into key considerations and subtle nuances that can make a significant difference. Firstly, understanding the coverage types available is essential. Most pet insurance policies fall into three main categories: accident-only, accident and illness, and wellness plans. Accident-only plans are typically the most affordable, covering unexpected injuries but excluding illnesses. On the other hand, accident and illness plans offer more comprehensive protection, encompassing a wide range of medical issues, albeit at a higher cost. Wellness plans, often offered as add-ons, cover routine care such as vaccinations and check-ups, promoting proactive health management. Another critical factor is the cost of premiums. Premiums can vary significantly based on factors such as your pet's age, breed, and location. It's advisable to obtain quotes from multiple providers and compare them meticulously. While a lower premium might seem attractive, it's crucial to consider the deductibles, reimbursement levels, and annual coverage limits. A plan with a lower premium but high deductibles and low reimbursement might not be cost-effective in the long run. Equally important is the exclusions and limitations inherent in pet insurance policies. Pre-existing conditions are universally excluded, and some breeds may face restrictions due to genetic predispositions. Moreover, age limits can affect eligibility; many insurers have age caps, meaning older pets might not qualify for new policies. It's vital to read the fine print and understand what is and isn't covered to avoid unexpected surprises when filing a claim. Customer service and claim processing are other crucial aspects to consider. The ease and efficiency of filing claims can vary widely among insurers. Look for companies with a reputation for prompt and hassle-free claim settlements. Online reviews and testimonials can provide valuable insights into customer satisfaction and the insurer's responsiveness. Additionally, some companies offer mobile apps that streamline the claims process, providing added convenience. Lastly, consider the reputation and stability of the insurance provider. Opting for a well-established company with a robust track record ensures reliability and financial stability. A provider's longevity in the market often reflects its ability to meet policyholder expectations and sustain operations over time. In conclusion, selecting the best pet insurance requires careful consideration of various factors, from coverage options and cost to exclusions and customer service. By thoroughly evaluating these elements, pet owners can make informed decisions that safeguard their pets' health and well-being, offering peace of mind amidst the uncertainties of pet ownership. https://www.petsbest.com/dog-insurance

Pets Best offers dog insurance plans that cover accidents, illness and more. Get up to 90% back on your dog's vet bills with our affordable dog insurance ... https://play.google.com/store/apps/details?id=com.petsbest&hl=en_US

File claims quickly and view your policy benefits with the Pets Best app! https://www.reddit.com/r/petinsurancereviews/comments/1ftovl4/our_experience_with_pets_best_insurance/

I'm really happy to report that Pets Best processed both of my claims related to Billie's surgery this week and we will be getting the full 80% reimbursed!

|